Business profile: Green Light Escrow

New payment app Green Light Escrow could be a game-changer for tradespeople to make payments and transactions

Necessity, it’s said, is the mother of invention, and approximately five years ago, plumbing and drainage contractor Max Semmons-Russel found himself in a position where he was presented with the perfect opportunity to put that theory into practice.

Like a lot of tradies, Max was busy putting in the hours and sending out invoices from his company KPA Plumbing Ltd, usually being rewarded with prompt payments for the work his company had carried out.

On one occasion, however, things didn’t go as expected. The company had completed a reasonable-sized job for a friend and duly prepared the bill with the usual expectation that payment would be forthcoming.

|

|

Max Semmons-Russel

|

However, after an inordinately long wait, the payment never arrived and eventually it became apparent that it wasn’t ever going to. Unlike most people who might waste a whole lot of energy on being angry about their situation, Max took a different approach and thought about finding a way to prevent this from happening again.

Figuring that he probably wasn’t the first person to find himself in a similar predicament, he set his mind to work on designing a solution to the problem, something that would not only benefit him but also others.

It didn’t take long for Max to realise that if there was a third party involved in the transaction, a place where any progress payments could be held in a trust, both the customer and the supplier would have their financial interests protected in case of a dispute.

After ruminating on the idea over the course of a few days, he ran the concept past a business-savvy friend who immediately saw value in Max’s concept. "Sounds like escrow," the friend said.

The word escrow is a terminology not usually heard outside of accounting practices and law firms, but Max believed he’d stumbled upon a concept that was worth pursuing.

Expanding on the idea that any money owing could only be released from the trust fund when the customer gave the green light signifying that they were happy with the work carried out, the company name Green Light Escrow Ltd was born.

A dictionary definition of the word ‘escrow’ essentially means: a bond, deed, or other document kept in the custody of a third party and taking effect only when a specified condition has been fulfilled.

Max says that getting Green Light Escrow up and running wasn’t an easy task by any stretch of the imagination and that ironing out bugs that have popped up from time to time has caused him a few sleepless nights, not to mention a fair chunk of the significant money he’s invested along the way.

Free set-up

Green Light Escrow is set up through an app on a standard smartphone or desktop, courtesy of an online tutoring tool or with Max’s one-on-one guidance for less tech-savvy individuals.

Set-up is free of charge and takes a few minutes to complete.

"The GreenLight Escrow system works equally as well for developers, sub-contractors and builders, as it does for private individuals," says Max.

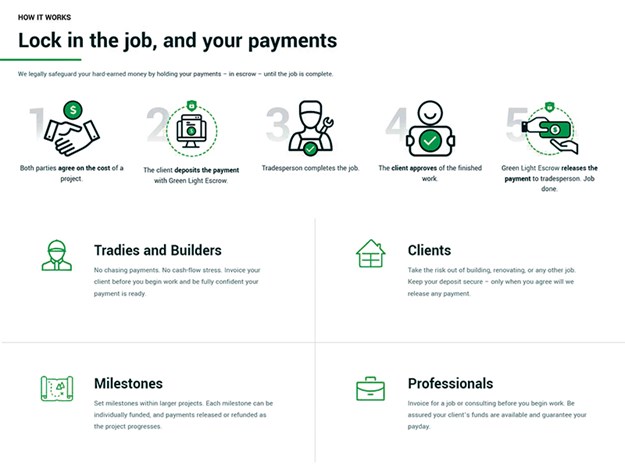

How the system works

- Both parties agree on a payment structure based on the job.

- The client submits a payment to GreenLight Escrow, and the contractor is alerted, allowing the job to begin.

- Contractor completes an agreed job milestone.

- The client agrees the job is tip-top and approves the job.

- Green Light Escrow releases payment to the contractor.

- Job done.

Fee structure

Max says there’s no subscription amount, no sign-up fees, and no hidden costs. A modest fee structure is charged, which is one percent (ex-GST) of the amount released to the tradesperson, up to a maximum of $100 per milestone, with a minimum of $5 per milestone.

Writer’s note: During the process of researching material for this article, I was speaking to an acquaintance who related a story whereby they wished they’d heard of GreenLight Escrow earlier, as had they used the system to pay for major work done on their truck, it would have meant the vehicle was back on the road and the repairer wouldn’t have swindled them for thousands of dollars.

In a complex commercial world where projects completed on a ‘handshake’ are few and far between these days, GreenLight Escrow is set to become the norm rather than the exception in the majority of business transactions.

For more information, contact Max Semmons-Russell at 020 411 726 44 or visit greenlightescrow.co.nz.

Keep up to date in the industry by signing up to Deals on Wheels' free newsletter or liking us on Facebook.

.jpg)

.jpg)

.png)

.png)

.png)